Real property is a valid term for the property you have –not only the land itself but the soil and minerals under it and some other permanent structures constructed on top of it. Everything is categorized in the law as private property. Real property is subject to taxation by various authorities, such as county and city government and school boards, based on the assessed value.

Time

All states set a specific date for analyzing the value of property; for instance, the very first day of July in New York state and Jan. 1 in California. The assessor will set the market value for the property on that date orif the law restricts the resale worth –will set the value in line with the law. In California, for instance, many pieces of property can not be assessed for over the preceding year’s worth, plus around 2 percent inflation.

Fair Market Value

“Fair market value”–what a savvy buyer and seller would agree is the acceptable price of this house –is a common guideline for assessing property. To figure out fair market value for your house, assessors check recent sales of similar buildings or property. They might also look at the construction market to determine what it might cost to construct a duplicate of any structures on your house and factor that information in. New York’s Department of Taxation says that sale or construction prices on one building are not enough to establish market value: To value property correctly, the assessor will need numerous examples of similar sales or structures.

Use

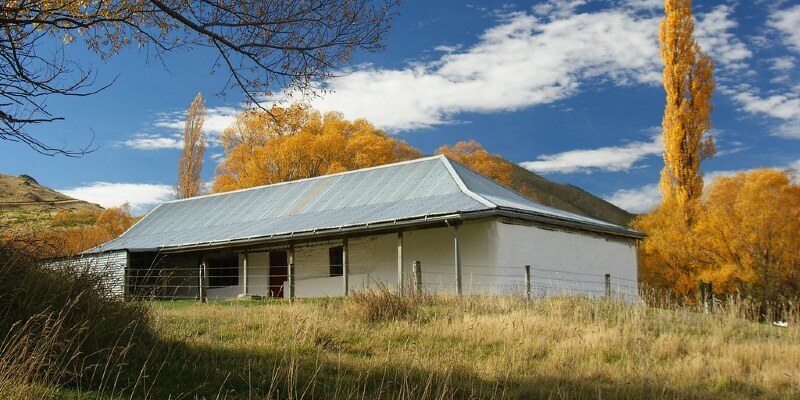

Some owners don’t use their property in its”highest and best use,” and this may affect how it’s assessed. If you own a farm beside a shopping centre, for instance, the fair market value would be based on someone getting and creating the farmland; a few states, however, attempt to preserve agricultural land by assessing it according to”current usage,” which means a lesser value and reduced taxation. New York State assesses all property based on current usage, unless it’s vacant–neither assembled nor farmed–in which case it will be assessed for its potential usage.