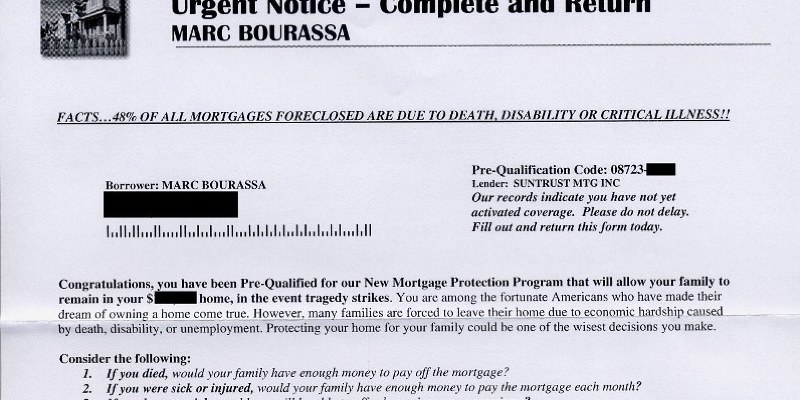

A reverse mortgage allows seniors tap the equitythe value in their home for money. Americans 62 and older who own and live in their own home can take out a mortgage, and until the owner goes out, the money does not need to be paid back, sells your home or expires. Ninety percent of mortgages are Home Equity Conversion Mortgages from the Federal Housing Administration.

Limitations

Reverse mortgage payouts are calculated using a formula which incorporates the present rates of interest, the appraised value of the home as well as for HECMs, the FHA mortgage limits in the area where the home is situated, according to the U.S. Department of Housing and Urban Development. Another factor is that the age of the homeowner. If the residence is jointly owned, the owner’s era is used for calculating the payout.

Size

The FHA, unlike other lenders that are reverse-mortgage, has a limit on how large an amount you can borrow from. The home value which can be used for calculating the dimensions of the HECM is $625,000, even if the home appraises for longer. According to the Mortgage Loan Place, you are able to borrow a maximum of 80 percent of the value of the home, provided you’re old enough to be eligible for that much. The AARP has an online calculator which can help you figure out how much you qualify for (see Resources).

Prices

Taking a reverse mortgage is not free. On an HECM a homeowner has to pay an origination fee based on a percentage of the home valueup to a maximum $6,000, HUD states. He also has to pay for a home appraisal and other closing costs. If the home has a mortgage, the owner must pay off it when he closes on the reverse mortgage. These prices cut into just what the owner will realize from the HECM.

Income

So as to be sure he will repay the mortgage back with a mortgage, lenders need proof of a borrower’s income. This limit does not hold using a mortgage: The calculation of how much an owner can borrow is exactly the same, regardless of income.

Endings

Provided that the owner keeps residing in the home, she does not need to make any payments on the mortgage. If she sells the home goes out or remains in centre or a nursing home for 12 weeks, she must pay back what she is borrowed, and interest. If she dies, her heirs or the estate must settle the debt, even if that means selling the home.

Considerations

Some conditions exist under which an owner can be made to pay a HECM while still residing at home, HUD states back. The owner remains responsible for maintaining the property, maintaining up homeowners insurance and paying land taxes; if the owner allows the house run down or does not pay the bills, the lender can cancel the mortgage and demand the money back.